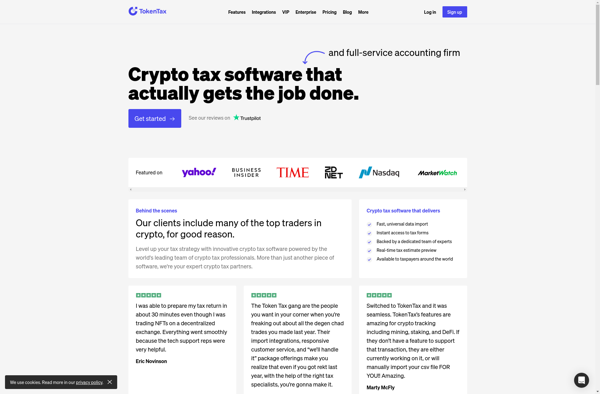

Description: TokenTax is cryptocurrency tax software designed to help users track, calculate, and report their cryptocurrency taxes. It connects to major exchanges and wallets to auto-import trades and allows users to manually input transaction data as well. TokenTax can generate necessary tax forms and documents.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: BearTax is tax preparation software designed specifically for independent contractors, freelancers, and small business owners. It guides users through the tax filing process in a simple step-by-step manner.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API