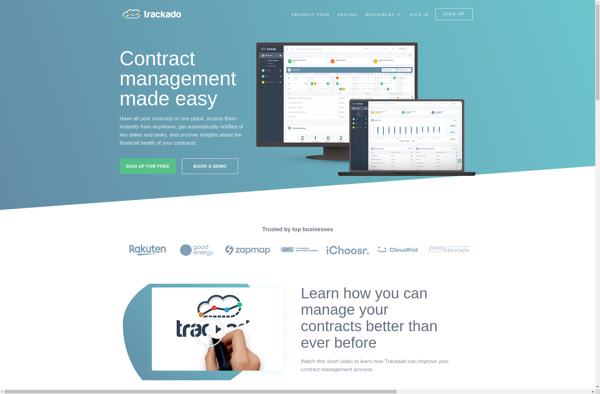

Description: Trackado is a marketing analytics software that specializes in providing attribution analytics to track the customer journey across channels. It integrates with Google Analytics and other platforms to attribute conversion value to different marketing touchpoints.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: PACTA is an open-source tool for analyzing climate transition risks and opportunities in financial portfolios. It enables financial institutions to measure the alignment of their portfolios with climate scenarios and goals.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API