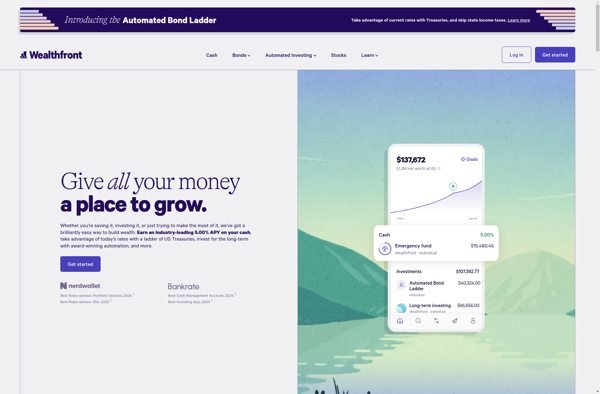

Description: Wealthfront is an automated investment service and robo-advisor that uses algorithms and software to build and manage customized investment portfolios based on a client's financial situation and goals. It aims to provide long-term, tax-efficient investing at low fees.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: WealthBar is a personal finance and investment tracking application. It allows users to link financial accounts, track spending, set budgets, analyze cash flow, and monitor investment performance across retirement, taxable, and banking accounts in one place.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API