CommonBond

CommonBond: Student Loans & Refinancing

CommonBond is an online lender providing student loans and refinancing options with competitive interest rates and flexible loan terms for borrowers to save money.

What is CommonBond?

CommonBond is an online financial services company that focuses on student loan refinancing and lending. Founded in 2011, CommonBond seeks to provide more affordable student loan options through competitive interest rates and customer-friendly terms.

CommonBond offers student loan refinancing options for those with existing federal and private student loans. Borrowers can potentially lower their interest rates and monthly payments. CommonBond also offers new student loans for graduate school, medical school, dental school and more. These loans feature low variable and fixed interest rates.

A key aspect of CommonBond is its social mission - for every loan it funds, the company contributes to the education of a child in need overseas. To date, over 3,000 students have beneftted from this program.

Some key benefits of CommonBond include:

- No application, origination or disbursement fees

- Unemployment protection to pause payments if job is lost

- Deferment and forbearance options

- Soft credit pull when prequalifying

- Cosigner release option after 24 months of on-time payments

Overall, CommonBond aims to provide an affordable and responsible student lending experience focused on saving borrowers money over the life of their loan.

CommonBond Features

Features

- Online student loan refinancing

- Competitive interest rates

- Flexible repayment terms

- Cosigner release option

- Unemployment protection

- Forbearance options

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

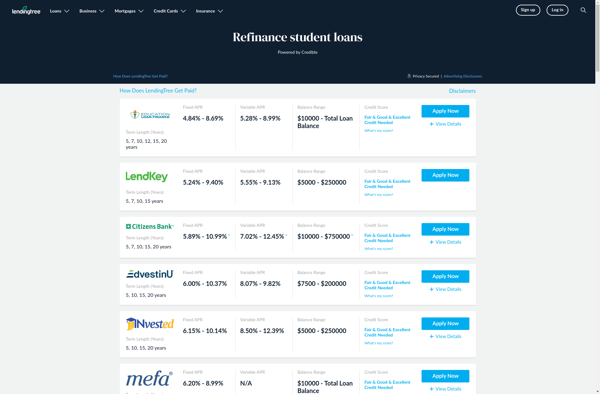

Login to ReviewThe Best CommonBond Alternatives

Top Business & Commerce and Financial Services and other similar apps like CommonBond

Here are some alternatives to CommonBond:

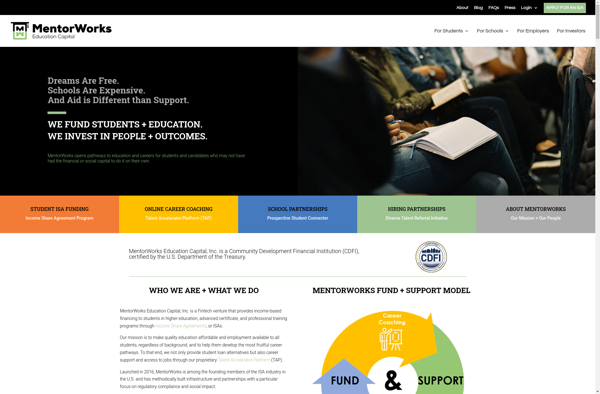

Suggest an alternative ❐MentorWorks Education Capital

Affirm

Karrot

LendingClub

Earnest

Student Loan Hero