Earnest

Earnest: Affordable Personal Loans

Earnest is a lending platform that uses artificial intelligence and machine learning to evaluate loan applications. It provides personal loans and refinancing for student loans and medical loans. Earnest aims to provide affordable loan rates based on the applicant's credit profile and earning potential rather than credit score alone.

What is Earnest?

Earnest is an online lending platform founded in 2013 that focuses on providing personal loans, student loan refinancing, and medical loan refinancing. It uses alternative data and machine learning algorithms to evaluate loan applicants beyond just credit scores. This allows Earnest to potentially offer better rates to those with limited credit history but good financial habits and income potential.

Here are some key things to know about Earnest:

- Loans ranging from $5,000 to $75,000 for personal loans, up to $150,000 for student loan refinancing

- No origination fees or prepayment penalties

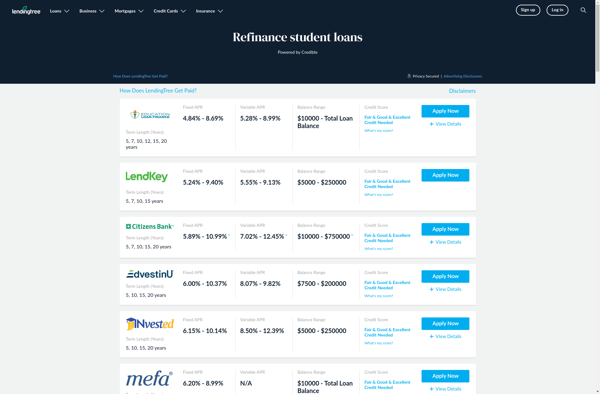

- Competitive fixed and variable rates based on financial profile

- Student loan refinancing for both federal and private student loans

- Earnest Health and Earnest Parent Loans catered specifically to medical and parental needs

- Online application, upload documents via mobile or web, get decision in minutes

- Free Earnest Second Lookâ„¢ if you get turned down initially

- Customer service 7 days a week

Earnest uses statistical modeling and machine learning paired with smart technology to deliver competitive loans efficiently to those underserved by big banks. Its non-traditional approach and focus on ability to repay aims to make lending more fair and inclusive for all kinds of borrowers.

Earnest Features

Features

- AI/machine learning-based credit evaluation

- Personal loans

- Student loan refinancing

- Medical loan refinancing

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Earnest Alternatives

Top Ai Tools & Services and Lending and other similar apps like Earnest

Here are some alternatives to Earnest:

Suggest an alternative ❐MentorWorks Education Capital

Affirm

Karrot

LendingClub

CommonBond

Student Loan Hero