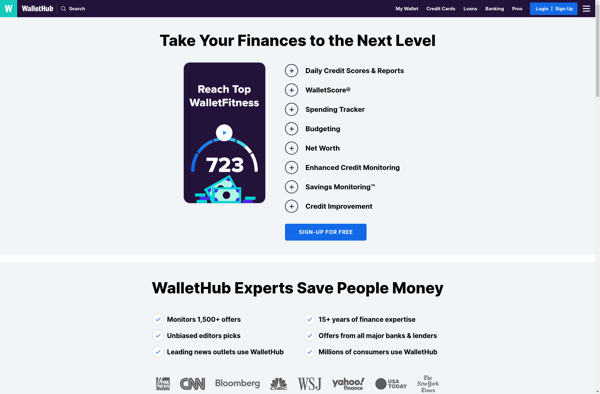

WalletHub

WalletHub: Personal Finance & Credit Score Analysis

WalletHub offers free credit scores, full credit reports, and reviews of financial products like credit cards, insurance, and loans, providing tools and tips for managing your money and making informed decisions.

What is WalletHub?

WalletHub is a leading personal finance website that empowers consumers to make better financial decisions by providing free credit scores, full credit reports, and reviews of financial products. Launched in 2009, WalletHub has become a go-to resource for over 100 million people looking to maximize their wallet.

At the core of the WalletHub experience are WalletLiteracy and TailoredAdvice. WalletLiteracy refers to the collection of tools and content WalletHub provides to educate people on topics like credit building and money management. This includes credit education alongside everyday financial tips blog. TailoredAdvice leverages user-specific financial data to provide custom product recommendations and alerts that save users money.

Key features that make WalletHub unique include:

- Free credit scores, full credit reports, and 24/7 credit monitoring

- Recommendations for credit cards, insurance, loans, and more

- Cost-of-living calculator and other basic financial calculators

- Local retailer deals, coupons and promo codes

- Question-and-answer platform to exchange financial advice

With expert financial analysts and advanced data science capabilities, WalletHub transforms raw financial data into understandable, actionable advice. The customizable dashboard and money-saving alerts provide ongoing support at every stage of a consumer's financial journey - not just when they're applying for credit.

WalletHub Features

Features

- Free credit scores

- Full credit reports

- Reviews of financial products

- Tools and tips for managing money

- Comparing financial products like loans and credit cards

Pricing

- Free

- Freemium

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best WalletHub Alternatives

Top Finance and Personal Finance and other similar apps like WalletHub

Here are some alternatives to WalletHub:

Suggest an alternative ❐Credit Sesame

Credit Karma

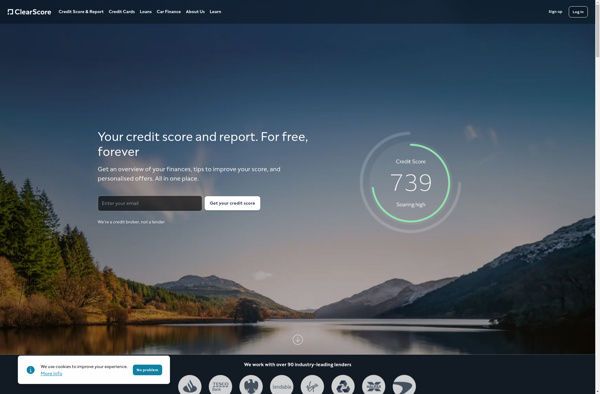

ClearScore

SuperMoney