ETFreplay.com

ProductName: Historical Data Analysis Tool for ETFs | ETFreplay.com

ETFreplay.com provides historical data and analysis tools for exchange traded funds (ETFs), allowing users to backtest ETF strategies and analyze performance over custom time periods.

What is ETFreplay.com?

ETFreplay.com is a financial analysis platform focused specifically on exchange traded funds (ETFs). It provides historical pricing data, performance analytics, and backtesting capabilities for thousands of ETFs traded in the US.

Some key features of ETFreplay.com include:

- Historical pricing data for US-listed ETFs going back over 10 years

- Customizable performance charts showing returns, volatility statistics, drawdowns, etc.

- Tools for analyzing ETF premiums/discounts, correlation, momentum, and other factors

- Backtesting for testing ETF strategies across different time periods and economic conditions

- Model portfolios and sample strategies for income, sector rotation, asset allocation, and more

- Robust screening to filter and compare ETFs by asset class, issuer, sector, and other attributes

ETFreplay.com aims to provide both retail and professional investors with the datasets and analytics to better understand ETF performance. It can be used for tasks ranging from simple historical lookups, to advanced strategy testing and risk analysis. The platform offers a wealth of resources for researching and analyzing ETF investing approaches.

ETFreplay.com Features

Features

- Historical data for thousands of ETFs

- Ability to backtest investment strategies on ETFs

- In-depth performance analysis tools

- Custom time period selection

- Visualizations and charting capabilities

- Portfolio optimization and asset allocation tools

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best ETFreplay.com Alternatives

Top Finance and Investing Tools and other similar apps like ETFreplay.com

Here are some alternatives to ETFreplay.com:

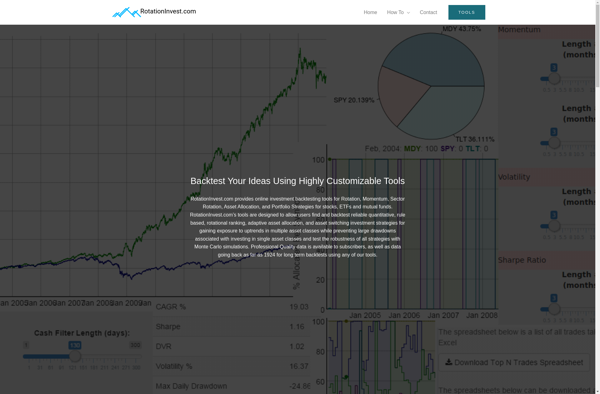

Suggest an alternative ❐RotationInvest.com

OpenHedgeFund