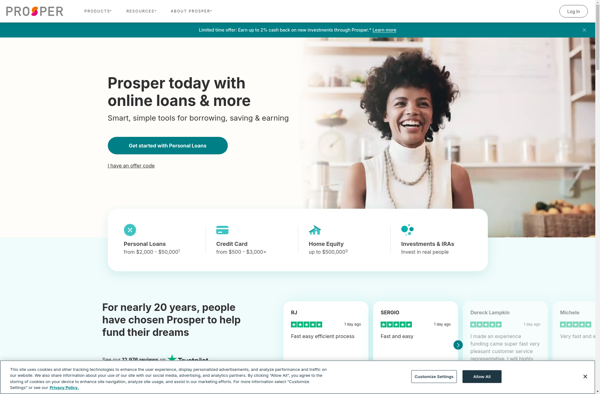

Prosper: Personal Loans

Prosper: Personal Loans

Borrow up to $40,000 with fixed-rate, fixed-term personal loans from individual and institutional investors. Earn interest based on credit risk.

What is Prosper: Personal Loans?

Prosper is an online peer-to-peer lending marketplace that enables borrowers to obtain personal loans between $2,000 and $40,000. Prosper connects borrowers with investors who fund the loans and earn interest based on the borrower's credit risk.

To apply for a Prosper personal loan, borrowers complete an online application where they provide details about their income, existing debts, credit score, and the loan amount they need. Prosper analyzes this information and assigns the borrower a Prosper Rating between AA (lowest risk) and HR (highest risk). Investors review loan listings and invest in those that match their risk tolerance and target rate of return.

Once enough investors commit funds to a loan listing to fulfill the borrower's requested loan amount, the loan is originated. Prosper services the loan by collecting borrower payments and distributing them to investors each month. Prosper charges lenders an annual loan servicing fee and borrowers an origination fee that is deducted from the loan proceeds.

Key features of Prosper personal loans include fixed rates, no prepayment penalties, quick funding, and the option to consolidate high-rate credit card balances. By using an online marketplace, Prosper aims to provide affordable rates for borrowers and attractive returns for investors.

Prosper: Personal Loans Features

Features

- Peer-to-peer lending platform

- Fixed rate personal loans from $2,000 to $40,000

- No prepayment penalties

- Competitive interest rates based on creditworthiness

- Automated loan funding

- Free credit score monitoring

- Mobile app for account management

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Prosper: Personal Loans Alternatives

Top Business & Commerce and Loans & Lending and other similar apps like Prosper: Personal Loans

Here are some alternatives to Prosper: Personal Loans:

Suggest an alternative ❐SoLo Funds

Hundy

Lenme

Lendee

Payday Advance

Tapcheck

Zirtue