Qapital

Qapital: Automatic Savings for a Secure Future

Qapital helps you save money automatically towards goals, categorizes spending, and connects to bank accounts and credit cards for seamless transactions.

What is Qapital?

Qapital is a personal finance and banking application designed to help users effortlessly save money towards goals or causes they care about. It integrates with users' bank accounts and credit cards in order to provide personalized insights and money management tools.

One of Qapital's key features is its automation rules, or what they call "rules". These allow users to easily save small amounts of money based on certain daily transactions or behaviors. For example, a user could set up a rule to round up every purchase to the nearest dollar and put the difference into their Qapital savings goal. Other rules might save $1 any time users spend over $10 on dining out or $5 whenever they spend money on clothing. These small amounts add up over time for less painful automated saving.

The app also provides customizable goals that users can save towards such as a vacation fund, down payment on a car, holiday shopping fund, or pay off debt goal. It calculates how long it will take users to reach their target amounts based on their connected spending accounts and weekly deposit plan. Goals feel more achievable thanks to Qapital's incremental, automated saving approach.

Key features include: automated saving rules based on transactions, customizable savings goals, FDIC insured balance up to $250,000, debit card to easily spend goal balances, easy integration with over 3,000 banks, weekly or monthly savings plans.

Qapital aims to make automated saving and reaching financial goals effortless. By seamlessly connecting spending accounts and gently setting aside small amounts users are unlikely to miss, it tries to help users save painlessly and reach their financial targets faster.

Qapital Features

Features

- Automatic saving rules

- Goal-based saving

- Spending categorization

- Connects to bank accounts

- Round-up saving

- Recurring transfers

Pricing

- Freemium

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Qapital Alternatives

Top Finance and Personal Finance and other similar apps like Qapital

Here are some alternatives to Qapital:

Suggest an alternative ❐Dobot

PrizePool

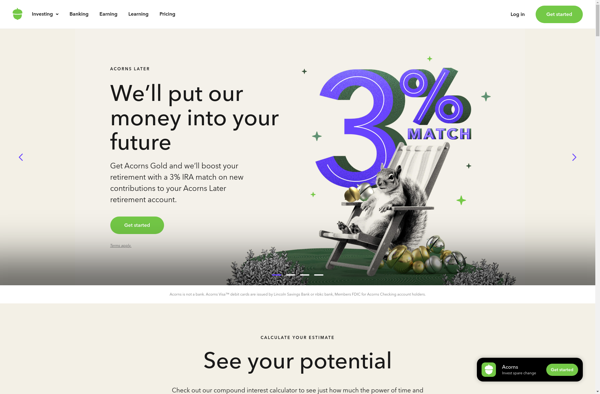

Acorns

Shift Savings