Track to Save

Track to Save: Personal Finance App

Track to Save is a personal finance app that helps users track their spending, create budgets, and save money. The app allows linking of bank accounts to automatically categorize transactions and provides spending insights and budget tracking.

What is Track to Save?

Track to Save is a personal finance and budgeting app designed to help users gain control of their spending, save money consistently, and work towards financial goals. The app allows users to link all their bank, credit card, investment, and other financial accounts in one place to track all cash flow.

Once accounts are linked, Track to Save automatically downloads transactions and uses proprietary technology to categorize each one, allowing users to see exactly where their money is going each month. The app provides intuitive spending insights and charts to visualize spending patterns.

Users can create customized budgets in Track to Save across any time interval and recurring expenses. The app monitors activity against these budgets and sends notifications when close to or over budget. Users can set up automatic transfers to their savings account too.

Key features of Track to Save include:

- Connects to over 10,000 financial institutions to link all accounts

- Automatically categorizes transactions from linked accounts

- Creates intuitive spending charts and graphs

- Allows creation of customizable budgets and spending goals

- Provides budget tracking and notifications for when close or over budget

- Enables auto-savings transfers to help consistently save money

- Offers bank-level security to protect user data

Overall, Track to Save combines expense tracking, intelligent categorization, customizable budgets, visual insights, goal setting, and automated saving to provide a complete financial picture and help users save more money.

Track to Save Features

Features

- Automatic transaction categorization

- Budget tracking

- Spending insights

- Bank account integration

- Bill reminders

- Goal setting

Pricing

- Freemium

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Track to Save Alternatives

Top Business & Commerce and Personal Finance and other similar apps like Track to Save

Here are some alternatives to Track to Save:

Suggest an alternative ❐Camelcamelcamel

Fetchee

PriceSpy

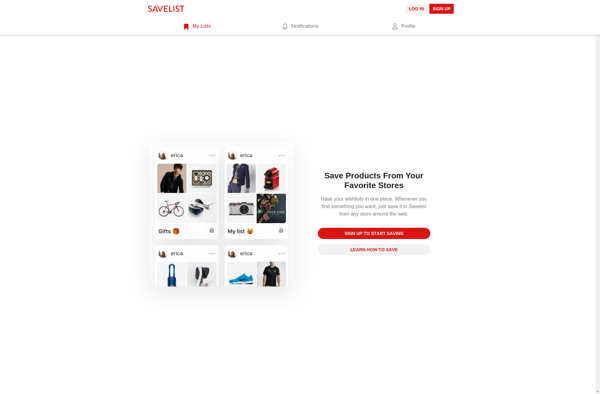

Savelist

Fiveandten

PriceBent.com

TrendLiker

The Watchlyst

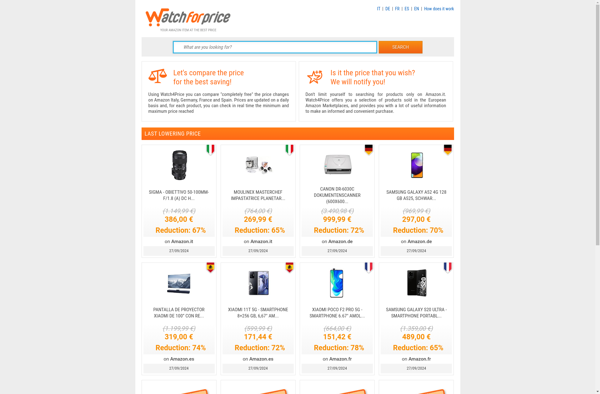

Watch4Price

6paq