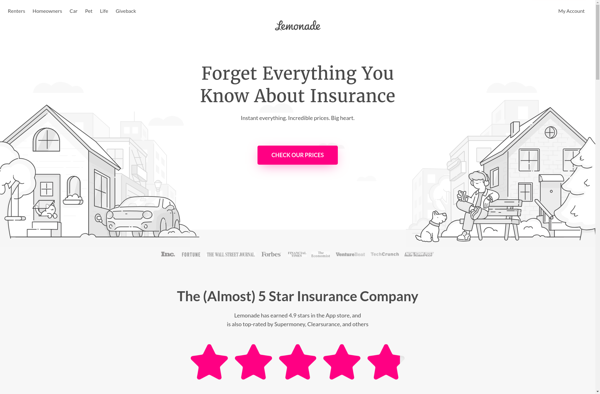

Lemonade

Lemonade: Affordable, Instant Homeowners & Renters Insurance

Lemonade is an insurance company powered by artificial intelligence and behavioral economics, offering affordable and instant homeowners and renters insurance with a fast and hassle-free claims process using chatbots and machine learning algorithms.

What is Lemonade?

Lemonade is an insurance technology company that offers homeowners and renters insurance powered by artificial intelligence and behavioral economics. Founded in 2015, Lemonade aims to provide more affordable, instant, and hassle-free insurance to consumers.

Lemonade uses chatbots and machine learning algorithms to deliver insurance policies and handle claims instantly, without paperwork. Customers interact with Maya, Lemonade's chatbot AI assistant, to get policy quotes and manage their insurance easily through a mobile app. The company analyzes data and leverages technology to assess risk levels accurately and process claims faster.

On the backend, Lemonade takes a flat fee and pools the remainder of premiums into a common claims pool. At the end of the year, money left in the pool goes to nonprofits chosen by its customers as a charitable donation. This business model aligns incentives between customers and the company itself, reducing conflicts of interest around paying or denying claims.

Key features of Lemonade include fast and paperless sign-up, mobile app access to policies, instant payments for valid claims, and the option to direct surplus premiums to charities. The company offers policies to homeowners and renters in various U.S. states. Backed by investors like Softbank and Sequoia Capital, Lemonade aims to disrupt the massive global insurance industry with its tech-driven approach.

Lemonade Features

Features

- AI-powered claims processing

- Instant policies and claims payments

- Affordable premiums

- User-friendly mobile app

- Behavioral economics approach

- Charitable giving program

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Lemonade Alternatives

Top Ai Tools & Services and Insurance and other similar apps like Lemonade

Here are some alternatives to Lemonade:

Suggest an alternative ❐Aflac Mobile

QuoteWizard

Insuranks

Leadsurance

Wrisk

PolicyX.com