Starling Bank

Starling Bank: Mobile Banking Without Fees

Online-only bank offering no monthly fees and overdraft charges for personal and business accounts, along with budgeting tools and savings options.

What is Starling Bank?

Starling Bank is an online-only, mobile-based bank founded in 2014 and headquartered in London, UK. It offers current accounts with no monthly fees and overdraft charges, as well as business accounts, joint accounts, savings accounts, budgeting tools, and more.

Starling aims to provide a simplified banking experience through its mobile app, which allows customers to easily track spending across multiple accounts, set budgets and savings goals, pay bills, send money to friends, and more. The app also includes useful features like instant spending notifications, ability to freeze/unfreeze cards, and AI-based anti-fraud monitoring.

Some key things that set Starling apart from traditional banks include:

- No monthly fees or overdraft charges

- Fast account setup done entirely through the app

- Access to over 300 local UK cash machines for free cash withdrawals

- Ability to temporarily block or freeze debit card if lost or stolen with a few taps

- Automatic categorization of spending to see where money goes each month

Starling is regulated in the UK by the Financial Conduct Authority and protected by the Financial Services Compensation Scheme up to £85,000 per person, giving customers peace of mind over the security of their money.

The company has received multiple awards for its innovative mobile banking platform and continues to roll out useful updates on a regular basis. Overall, Starling provides an efficient, transparent and flexible alternative for day-to-day banking needs to traditional bank accounts.

Starling Bank Features

Features

- Current accounts with no monthly fees

- Overdrafts with no hidden fees

- Savings accounts with competitive interest rates

- Joint accounts

- Business accounts

- In-app budgeting tools

- Ability to freeze/unfreeze card anytime

- Fast account switching service

- Integrations with accounting software

- Supports Apple Pay, Google Pay, Samsung Pay

Pricing

- Freemium

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Starling Bank Alternatives

Top Business & Commerce and Banking & Finance and other similar apps like Starling Bank

Skrill

Revolut

Paysera

Cash App

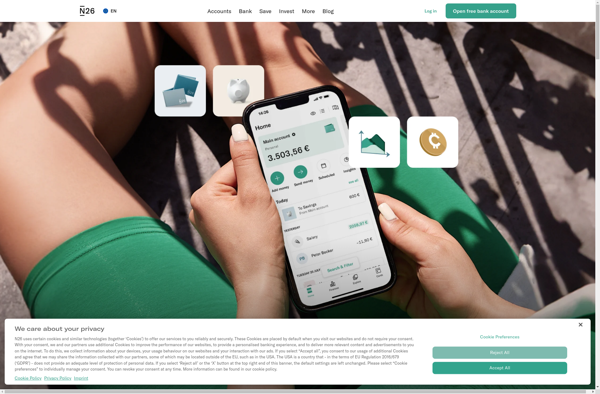

N26

OnJuno

Monese

Copper Banking